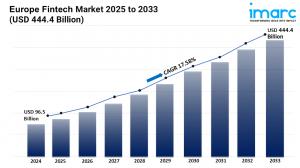

Europe Fintech Market to Worth USD 444.4 Billion by 2033 | With a Striking 17.58% CAGR - IMARC Group

Europe fintech market hit USD 96.5B in 2024 and is projected to reach USD 444.4B by 2033, growing at a 17.58% CAGR from 2025 to 2033.

LONDON, GREATER LONDON, UNITED KINGDOM, June 25, 2025 /EINPresswire.com/ -- Europe Fintech Market OverviewMarket Size in 2024: USD 96.5 Billion

Market Forecast in 2033: USD 444.4 Billion

Market Growth Rate: 17.58% (2025-2033)

According to the latest report by IMARC Group, the Europe fintech market size was valued at USD 96.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 444.4 Billion by 2033, exhibiting a CAGR of 17.58% from 2025-2033.

Europe Fintech Industry Trends and Drivers:

The Europe fintech industry is experiencing robust expansion as digital innovation continues transforming the financial services landscape. Businesses are actively shifting towards agile deployment strategies, with cloud-based models gaining significant momentum across banking and insurance institutions. This transition is accelerating due to the growing demand for flexible infrastructure that supports real-time data processing and secure remote access. Simultaneously, on-premises solutions are maintaining relevance among organizations prioritizing customized data control and stringent compliance adherence. The rise in fintech adoption is strongly aligning with broader digitization trends, where secure data ecosystems, scalable technologies, and seamless integration are becoming vital differentiators. Market players are strategically leveraging these deployment preferences to meet varying institutional needs while enhancing user experiences and operational efficiency.

Technological innovation is serving as a powerful catalyst for the fintech ecosystem in Europe, with API-driven platforms, artificial intelligence, blockchain, and robotic process automation reshaping digital engagement models. Financial institutions are consistently integrating AI-powered tools for fraud detection, predictive analytics, and customer personalization, streamlining decision-making and optimizing service delivery. Blockchain is further revolutionizing transactional security and transparency, especially in cross-border payments and smart contracts. Meanwhile, robotic process automation is minimizing repetitive tasks and driving back-office efficiency. Data analytics remains central to strategic planning, helping firms derive actionable insights from user behavior and market fluctuations. These advancements are not only enabling cost efficiency but are also fostering inclusive financial services across underserved populations. This technological synergy is reinforcing Europe’s position as a hub for fintech-driven transformation.

Across diverse applications, fintech solutions are steadily revolutionizing payment systems, personal finance management, and wealth advisory services. Consumers are increasingly engaging with digital wallets, instant fund transfers, and mobile banking applications due to enhanced accessibility and usability. Lenders are optimizing credit assessment and loan disbursement via AI-based risk profiling, while insurers are deploying predictive algorithms to improve claims management. In personal finance and wealth management, platforms are offering tailored investment advice through robo-advisors and real-time market insights. End users in banking, insurance, and securities sectors are showing strong preference for integrated fintech platforms to ensure speed, accuracy, and compliance. Countries across Europe including Germany, France, and the Nordics are showcasing diverse growth trajectories based on regulatory alignment, technological readiness, and consumer behavior. The market is therefore witnessing a synchronized shift toward intelligent financial ecosystems capable of driving sustainable value creation.

Download sample copy of the Report: https://www.imarcgroup.com/europe-fintech-market/requestsample

Europe Fintech Industry Segmentation:

The report has segmented the market into the following categories:

Deployment Mode Insights:

• On-premises

• Cloud-based

Technology Insights:

• Application Programming Interface

• Artificial Intelligence

• Blockchain

• Robotic Process Automation

• Data Analytics

• Others

Application Insights:

• Payment and Fund Transfer

• Loans

• Insurance and Personal Finance

• Wealth Management

• Others

End User Insights:

• Banking

• Insurance

• Securities

• Others

Country Insights:

• Germany

• France

• United Kingdom

• Italy

• Spain

• Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• COVID-19 Impact on the Market

• Porter’s Five Forces Analysis

• Strategic Recommendations

• Historical, Current and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Structure of the Market

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=10527&flag=C

Browse more research report:

Germany Renewable Energy Market Size

Europe Electric Vehicles Market Share

Europe Ammunition Market Size: https://www.imarcgroup.com/Europe-Ammunition-Market

Europe Tobacco Market Size: https://www.imarcgroup.com/Europe-Tobacco-Market

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Elena Anderson

IMARC Services Private Limited

+1 631-791-1145

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.