July 18, 2025, is the Last Day for Rutland Township Appeals

CHICAGO, IL, UNITED STATES, July 10, 2025 /EINPresswire.com/ --

Like Sugar Grove and Geneva before it, Rutland Township is the next part of Kane County to see a rise in property values. While Illinois is becoming infamous for constantly increasing property values, Kane County is being hit particularly hard. Rutland Township itself is also on the cusp of a transition, much like the rest of Kane County. Traditionally a rural area, Rutland Township has seen some of the fastest population growth in all of Illinois, which makes property even more desirable and in-demand.

To combat ever-increasing values and taxes, many in Rutland Township are turning to property tax appeals. This is the only method that allows a taxpayer to reduce their property values and, by extension, their taxes. However, the deadline for filing appeals is quickly approaching, with July 18, 2025, being the last day that it will be possible to appeal. O'Connor will discuss what increases are available and how to lower them.

Property Values Increasing Outside Reassessment

While quadrennial reassessment is set for 2027, that does not mean that townships across the state are sitting on their property values. Township assessors are required to assess properties every four years, but many do so annually. To determine what property values are, local assessors look at the past three years of home sales and use these numbers to calculate how much related properties should decrease or rise in taxable value. Along with a township or county equalization factor, this can lead to a property’s value being different from year to year. The Rutland Township equalization factor for 2025 has been set at 1.0843, which will be applied to new property values to establish a taxable base. Then this number will be used along with a tax rate to create a bill.

Rutland Township Property Values Increase by 9%

The final assessed fair market value for Rutland Township residential property in 2024 was $3.82 billion. The Rutland Township Assessor has announced that this has increased by 9% to $4.15 billion. As stated above, this is based on three years of home sales compared to previous assessments. Computer-aided mass appraisal is then typically used to apply a blanket rate to homes with little or no regard for the facts on the ground or how current market trends are moving.

When taxable value is broken down into categories based on the worth of properties, taxpayers can see a pattern developing. $3.04 billion in value was created by homes valued between $250,000 and $500,000. This is to be expected for a rural, suburban, or middle-class area. This category of homes was saddled with an increase of 9%, the highest out of all residential properties. Representing the majority of homes, this cost bump caused a ripple effect that lifted the entire township’s total value significantly. This translates into a taxable value increase of $247.77 million.

While all other categories are dwarfed by the value of homes worth between $250,000 and $500,000, that does not mean that they are feeling the pinch as well. All other categories of homes saw an increase of 8%. Homes worth between $500,000 and $750,000 are the second-largest block, seeing a rise in their combined value totaling $50.49 million. Even the smallest homes saw a combined rise of $29.04 million. Due to their small number, homes worth over $1.5 million were the lightest hit, yet still saw an increase of 8% to their taxable value.

Businesses on the Hook for a 9% Value Jump

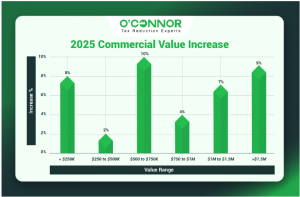

Property values in Rutland Township did not only rise for homeowners, but businesses are also feeling the sting. Going from a 2024 total of $637.38 million to $692.70 million, commercial properties experienced an increase of 9%. Unlike homes, businesses saw a much wider variety of value increases thrown at them, with the final numbers being dependent on the initial worth of the properties in question. This is typical for Illinois in general, as homeowners tend to see larger and more uniform increases.

The majority of total value was reserved for businesses worth more than $1.5 million. These large commercial properties combined for a total of $522.55 million, or 75.44% of all value. This was after a 9% increase was handed out by the Rutland Township Assessor, which equaled to a jump of $44.80 million. This could be a significant contributor to business overhead and may even lead to higher prices being passed on to the consumer.

All other commercial properties received a cornucopia of value increases. Businesses worth between $250,000 and $500,000 saw a jump of only 2%, while those worth between $500,000 and $750,000 saw their taxable value soar by 10%. The smallest commercial properties, those that can least afford it, saw a leap of 8%. All of these various smaller increases translated into a total value hike of $170.15 million.

You Must Appeal Before July 18, 2025

Property owners of all stripes across Illinois have the right to protest their assessed property values. In fact, the situation across Illinois is becoming so dire that many assessors, including those in Cook County, are encouraging taxpayers to protest against the very values that assessors are handing out. Even assessors are seeing the flaws in the system they are a part of, particularly in cases where high property values are meeting increasing tax rates. In some areas of Illinois, assessors are even blaming various Boards of Review (BOR) for overriding their assessments.

Illinois has been seeing record property tax protests in the past year, which is understandable, considering only New Jersey has higher taxes. As we have seen, these unreasonable values are not limited to Chicago or Aurora but are spilling outside into even the most remote areas of the state. This means that all taxpayers must be vigilant, whether they own a home or business.

Citizens of each township have only 30 days to protest their property values after notice is given. In the case of Rutland Township, the cutoff date is July 18, 2025. This extends to all property tax protest types. In Cook County, there is one deadline for informal appeals and another for BOR informal hearings, but this is not the case in Rutland Township. No matter the type or size of an appeal, it must be filed by the deadline. This means that taxpayers are down to only a handful of days before they are stuck with their unfair 2025 values.

Join O’Connor and Find Relief

While the clock to protest Rutland Township property taxes is running down, the buzzer has yet to ring. Taxpayers can make an informal protest to the township assessor or pursue a BOR hearing independently, but it always helps to have a trustworthy partner. Especially when time is running out and there is so much left to do. Taxpayers could do all the research, put together all the evidence, and reach out to the right government officials, or they could let a firm with 50 years of experience do the heavy lifting.

As one of the largest property tax specialist firms in the United States, O’Connor has the people, resources, and expertise needed to get the best deal. We have a world-class database that can compare properties across the township, finding the perfect samples to prove the case. We have an office in Aurora, with experts that know the required evidence for every assessor or BOR by heart. Best of all, clients will only pay if taxes are lowered.

If the taxpayer is unable to file an appeal for the 2025 tax season, then O'Connor can at least be ready to protest in 2026 and beyond. O'Connor will protest the client's taxes annually and will be especially focused on the 2027 reassessment window. When joining O'Connor, our team will ensure that the taxpayer never misses a deadline again and will never have to worry about a surprise from reassessment, the equalizer, or hidden tax rates. Our team is passionate about fighting property taxes, especially ones as unfair as those in Illinois and would love to be the champion in the taxpayer's fight against the Rutland Township Assessor and beyond.

About O’Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Illinois, New York, Texas, and Georgia. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Like Sugar Grove and Geneva before it, Rutland Township is the next part of Kane County to see a rise in property values. While Illinois is becoming infamous for constantly increasing property values, Kane County is being hit particularly hard. Rutland Township itself is also on the cusp of a transition, much like the rest of Kane County. Traditionally a rural area, Rutland Township has seen some of the fastest population growth in all of Illinois, which makes property even more desirable and in-demand.

To combat ever-increasing values and taxes, many in Rutland Township are turning to property tax appeals. This is the only method that allows a taxpayer to reduce their property values and, by extension, their taxes. However, the deadline for filing appeals is quickly approaching, with July 18, 2025, being the last day that it will be possible to appeal. O'Connor will discuss what increases are available and how to lower them.

Property Values Increasing Outside Reassessment

While quadrennial reassessment is set for 2027, that does not mean that townships across the state are sitting on their property values. Township assessors are required to assess properties every four years, but many do so annually. To determine what property values are, local assessors look at the past three years of home sales and use these numbers to calculate how much related properties should decrease or rise in taxable value. Along with a township or county equalization factor, this can lead to a property’s value being different from year to year. The Rutland Township equalization factor for 2025 has been set at 1.0843, which will be applied to new property values to establish a taxable base. Then this number will be used along with a tax rate to create a bill.

Rutland Township Property Values Increase by 9%

The final assessed fair market value for Rutland Township residential property in 2024 was $3.82 billion. The Rutland Township Assessor has announced that this has increased by 9% to $4.15 billion. As stated above, this is based on three years of home sales compared to previous assessments. Computer-aided mass appraisal is then typically used to apply a blanket rate to homes with little or no regard for the facts on the ground or how current market trends are moving.

When taxable value is broken down into categories based on the worth of properties, taxpayers can see a pattern developing. $3.04 billion in value was created by homes valued between $250,000 and $500,000. This is to be expected for a rural, suburban, or middle-class area. This category of homes was saddled with an increase of 9%, the highest out of all residential properties. Representing the majority of homes, this cost bump caused a ripple effect that lifted the entire township’s total value significantly. This translates into a taxable value increase of $247.77 million.

While all other categories are dwarfed by the value of homes worth between $250,000 and $500,000, that does not mean that they are feeling the pinch as well. All other categories of homes saw an increase of 8%. Homes worth between $500,000 and $750,000 are the second-largest block, seeing a rise in their combined value totaling $50.49 million. Even the smallest homes saw a combined rise of $29.04 million. Due to their small number, homes worth over $1.5 million were the lightest hit, yet still saw an increase of 8% to their taxable value.

Businesses on the Hook for a 9% Value Jump

Property values in Rutland Township did not only rise for homeowners, but businesses are also feeling the sting. Going from a 2024 total of $637.38 million to $692.70 million, commercial properties experienced an increase of 9%. Unlike homes, businesses saw a much wider variety of value increases thrown at them, with the final numbers being dependent on the initial worth of the properties in question. This is typical for Illinois in general, as homeowners tend to see larger and more uniform increases.

The majority of total value was reserved for businesses worth more than $1.5 million. These large commercial properties combined for a total of $522.55 million, or 75.44% of all value. This was after a 9% increase was handed out by the Rutland Township Assessor, which equaled to a jump of $44.80 million. This could be a significant contributor to business overhead and may even lead to higher prices being passed on to the consumer.

All other commercial properties received a cornucopia of value increases. Businesses worth between $250,000 and $500,000 saw a jump of only 2%, while those worth between $500,000 and $750,000 saw their taxable value soar by 10%. The smallest commercial properties, those that can least afford it, saw a leap of 8%. All of these various smaller increases translated into a total value hike of $170.15 million.

You Must Appeal Before July 18, 2025

Property owners of all stripes across Illinois have the right to protest their assessed property values. In fact, the situation across Illinois is becoming so dire that many assessors, including those in Cook County, are encouraging taxpayers to protest against the very values that assessors are handing out. Even assessors are seeing the flaws in the system they are a part of, particularly in cases where high property values are meeting increasing tax rates. In some areas of Illinois, assessors are even blaming various Boards of Review (BOR) for overriding their assessments.

Illinois has been seeing record property tax protests in the past year, which is understandable, considering only New Jersey has higher taxes. As we have seen, these unreasonable values are not limited to Chicago or Aurora but are spilling outside into even the most remote areas of the state. This means that all taxpayers must be vigilant, whether they own a home or business.

Citizens of each township have only 30 days to protest their property values after notice is given. In the case of Rutland Township, the cutoff date is July 18, 2025. This extends to all property tax protest types. In Cook County, there is one deadline for informal appeals and another for BOR informal hearings, but this is not the case in Rutland Township. No matter the type or size of an appeal, it must be filed by the deadline. This means that taxpayers are down to only a handful of days before they are stuck with their unfair 2025 values.

Join O’Connor and Find Relief

While the clock to protest Rutland Township property taxes is running down, the buzzer has yet to ring. Taxpayers can make an informal protest to the township assessor or pursue a BOR hearing independently, but it always helps to have a trustworthy partner. Especially when time is running out and there is so much left to do. Taxpayers could do all the research, put together all the evidence, and reach out to the right government officials, or they could let a firm with 50 years of experience do the heavy lifting.

As one of the largest property tax specialist firms in the United States, O’Connor has the people, resources, and expertise needed to get the best deal. We have a world-class database that can compare properties across the township, finding the perfect samples to prove the case. We have an office in Aurora, with experts that know the required evidence for every assessor or BOR by heart. Best of all, clients will only pay if taxes are lowered.

If the taxpayer is unable to file an appeal for the 2025 tax season, then O'Connor can at least be ready to protest in 2026 and beyond. O'Connor will protest the client's taxes annually and will be especially focused on the 2027 reassessment window. When joining O'Connor, our team will ensure that the taxpayer never misses a deadline again and will never have to worry about a surprise from reassessment, the equalizer, or hidden tax rates. Our team is passionate about fighting property taxes, especially ones as unfair as those in Illinois and would love to be the champion in the taxpayer's fight against the Rutland Township Assessor and beyond.

About O’Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Illinois, New York, Texas, and Georgia. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.