Pharmaceutical Excipients Market Size Expected to Reach USD 15.49 Bn by 2034

The global pharmaceutical excipients market is estimated at USD 10.83 billion in 2025 and is projected to reach USD 15.49 billion by 2034, expanding at a CAGR of 4.06%.

Ottawa, Sept. 11, 2025 (GLOBE NEWSWIRE) -- According to a study released by Towards Healthcare, a sister company of Precedence Research, the global pharmaceutical excipients market was valued at USD 10.41 billion in 2024 and is anticipated to reach nearly USD 15.49 billion by 2034, advancing at a CAGR of 4.06% over the forecast period.

Ongoing R&D activities and a rise in demand for diverse specialty drugs and biologics are boosting the demand for pharmaceutical excipients.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5535

Key Takeaways

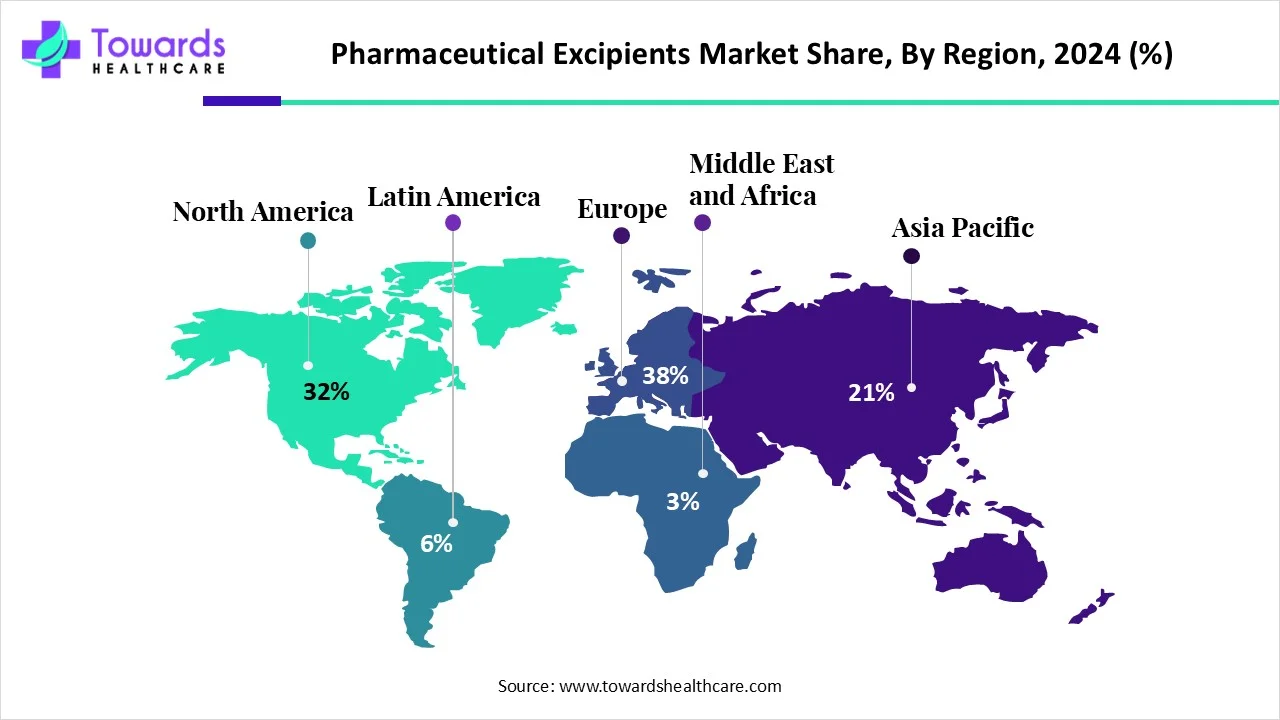

- Europe was dominant in the pharmaceutical excipients market by 38% share in 2024.

- Asia-Pacific is expected to grow at a rapid CAGR in the studied years.

- By product, the polymers segment dominated the market in 2024.

- By product, the alcohols segment is expected to grow fastest during 2025-2034.

- By formulation, the oral segment registered dominance in the pharmaceutical excipients market in 2024.

- By formulation, the topical segment is expected to grow at a notable CAGR in the coming years.

- By function, the binders segment was dominant in the global market in 2024.

- By function, the coating agents segment is expected to witness a significant expansion during 2025-2034.

Market Overview & Potential

During the production of drug products, various kinds of pharmaceutical excipients are used with their inactive nature to enhance drug stability and bioavailability. Also, this accelerates a robust delivery of the active pharmaceutical ingredient (API). The global pharmaceutical excipients market is widely developing nanotechnology-based excipients for expanded solubility and targeted delivery. Alongside other developments, including functional excipients with improved properties, and a wider emphasis on eco-friendly, green excipients derived from renewable resources, are impacting the transformation of drug manufacturing.

What are the Major Drivers in the Pharmaceutical Excipients Market?

Primarily, globally evolving biopharmaceuticals and biosimilars are boosting a wider need for specialized excipients for efficient formulation and delivering complex, high molecular weight compounds. Along with this, several expiring patents for more effective drugs are resulting in the escalating manufacturing of generic therapeutics, which demands that high-quality excipients are vital for maintaining drug equivalency and stability. The world is facing the evolution of new and rare diseases or severe health issues, which is fueling the robust and advanced drug development process, ultimately impacting the higher demand for excipients in these processes.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Key Drifts in the Pharmaceutical Excipients Market?

The expansion of the pharmaceutical and biotechnology industries is supporting the development of novel drug products, coupled with a broader need for excipients.

- In August 2025, Axplora, a global provider of API small molecule manufacturing, invested at its Vizag site in India to accelerate production capacity and reinforce supply chain resilience.

- In June 2025, BASF expanded its commitment to the biopharma and pharmaceutical ingredients industries through a new investment in North America.

- In May 2025, Univar Solutions LLC, a leading global solutions provider to users of specialty ingredients and chemicals, partnered with Shandong Head Group Co., Ltd., to boost its supply of cellulose ethers and pharmaceutical excipients.

What is the Emerging Limitation in the Market?

The global pharmaceutical excipients market is facing a critical hurdle, such as the stricter regulations offered by the FDA and EMA, which necessitate rigorous testing, documentation, and validation, ultimately escalating expenses and extending timelines for product development and approval.

Regional Analysis

How did Europe hold a Major Share of the Market in 2024?

In 2024, Europe captured the biggest revenue share of 38% in the pharmaceutical excipients market. This region is widely focused on the transformation of precision medicine, as well as other innovations in drug delivery approaches. For this, Europe is evolving controlled-release tablets, inhalers, and transdermal patches, which demand specialized excipients to expand bioavailability, stability, and targeted delivery. This region’s regulatory agency is fostering pharmaceutical sovereignty and local production, spurred by COVID-19 supply chain vulnerabilities.

For instance,

- In February 2025, Brenntag entered into a strategic partnership with MEGGLE Excipients, a manufacturer of pharmaceutical excipients, with an exclusive distribution agreement.

Why did the Asia Pacific Grow Significantly in the Market in 2024?

In the prospects, the Asia Pacific is predicted to expand rapidly in the pharmaceutical excipients market. A prominent driver for ASAP market growth is supportive government policies, allied with crucial investments in pharmaceutical R&D and healthcare infrastructure, which are fostering market expansion in India and China. Additionally, in the current date, ASAP is aiming at the introduction of novel, high-performing excipients for moisture-sensitive and parenteral drugs. Moreover, other breakthroughs in cellulose-based biopolymers are also assisting the overall drug stability.

For this market,

- In May 2025, Barentz, a leading global specialty ingredients solutions provider, acquired Fengli Group to strengthen the company’s pharmaceuticals market presence in the Asia Pacific.

- In April 2025, Shin-Etsu Chemical invested ¥10 B in the pharma cellulose biz in Japan and Europe to expand its supply system as a pharmaceutical excipient manufacturer.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Segmental Insights

By product analysis

Which Product Led the Pharmaceutical Excipients Market in 2024?

The polymers segment accounted for a major share of the market in 2024. The pharma world is focusing on the widespread use of biocompatible and biodegradable polymers in drug production is supporting a wider adoption of polymers. Highly specialized polymer coatings are being increasingly employed to preserve tablets, control drug release, and enhance the palatability of pharmaceutical products. Nowadays, other approaches, such as dendrimers, block copolymers, and polymer brushes, are allowing the generation of nanoparticles with controlled size, shape, and surface functionality.

On the other hand, the alcohols segment is estimated to register the fastest growth in the predicted timeframe. Alcohols possess a vital role in enhancing drug solubility, bioavailability, and stability. Besides this, the ongoing applications of pharmaceutical-grade alcohols, especially ethanol, are widely employed in drug manufacturing, disinfectants, and homeopathic products is acting as a major influential factor. Also, the broader range of methanol acts as a crucial solvent in drug synthesis for Active Pharmaceutical Ingredients (APIs), in the extraction and purification of natural products, and as a mobile phase in chromatography.

By formulation analysis

Why did the Oral Segment Dominate the Market in 2024?

In 2024, the oral segment was dominant in the pharmaceutical excipients market. Emerging advantages of this type of formulation, including ease of administration, non-invasive nature, and suitability for self-medication, are boosting the overall drug production. However, the use of diverse binders, disintegrants, stabilizers, and solubilizers is eventually needed for complex oral drug formulations is ultimately expanding the adoption of pharmaceutical excipients. Moreover, highly developed poloxamers, polymeric nanoparticles, and P-glycoprotein (P-gp) inhibitors are also merged to optimize drug absorption and extend release profiles.

Although the topical segment is anticipated to expand significantly during 2025-2034. A rise in focus on patient-friendly care and interest in cosmeceuticals that combine cosmetic and therapeutic advantages is bolstering the wider adoption of topical formulations. These formulations use different plant-derived excipients, like xanthan gum for thickening and stabilization, agar-agar for gelling, and olive and coconut oils for their emollient, anti-inflammatory, and moisturizing properties. Currently, various excipients are being evolved to work with advanced therapies targeting cellular and genetic levels, like signaling enzyme inhibitors, skin microbiome modulators, and cell-based therapies for issues, mainly epidermolysis bullosa.

By function analysis

What Made the Binders Segment Dominant in the Market in 2024?

The binders segment accounted for the dominating share of the pharmaceutical excipients market in 2024. The segment is driven by widespread development of new tablet and capsule formulations, particularly innovative drug delivery systems, such as modified-release tablets are enhancing the requirement for specialized binders for their improved properties. Especially, in the precise formulation of low-dose, high-potency drugs, and exploring advanced granulation techniques, specifically reverse wet granulation, is propelling the need for various types of binders.

Besides this, the coating agents segment is predicted to witness a notable expansion. This type of agent possesses beneficial effects in sustained or delayed release of the active pharmaceutical ingredient (API). Whereas, revolutionary nanotechnology is supporting to development of nanocoatings to expand drug release profiles, bioavailability, and allow the incorporation of functional materials. 2025 is stepping into solvent-free techniques, especially electrostatic coating to replace traditional solvent-based processes, the development of ready-to-use premixes for quicker application, and the integration of intelligent polymers, like PVA, for optimized properties like moisture barriers and sustained release.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

What are the Latest Developments in the Pharmaceutical Excipients Market?

- In July 2025, Roquette, a provider of plant-based ingredients and pharmaceutical excipients, launched POLYOX Extended Stability (ES) packaging to advance excipient stability and sustainability.

- In June 2025, Lubrizol announced that an Apisolex polymer excipient-enabled drug formulation is in Phase 1 clinical trials.

- In May 2025, Pharcos Specialty Ltd., a pioneer in specialty chemicals and excipients, launched Pharcocel, India’s first domestically manufactured Hydroxypropyl Methylcellulose (HPMC) excipient.

Pharmaceutical Excipients Market Key Players

- Ashland, Inc.

- Clariant Health Care

- DFE Pharma

- DuPont

- Evonik

- GELITA

- Ingredion

- Lubrizol Corporation

- MEGGLE Pharma

- Roquette

- SD Head USA LLC

- Sigachi Industries Pvt. Ltd.

- Signet Excipients

Browse More Insights of Towards Healthcare:

The global cannabidiol (CBD) market was valued at USD 8.97 billion in 2024, rising to USD 10.38 billion in 2025, and is anticipated to reach approximately USD 38.97 billion by 2034, expanding at a CAGR of 15.83% from 2025 to 2034.

The global plasmid purification market stood at USD 1.95 billion in 2024, increased to USD 2.18 billion in 2025, and is forecasted to touch USD 5.88 billion by 2034, progressing at a CAGR of 11.64% during the forecast period.

The active pharmaceutical ingredients (API) CDMO market was valued at USD 127.45 billion in 2024, grew to USD 136.92 billion in 2025, and is expected to climb to nearly USD 260.98 billion by 2034, advancing at a CAGR of 7.43% between 2025 and 2034.

The global cell and gene therapy CDMO market accounted for USD 6.41 billion in 2024, expanded to USD 8.2 billion in 2025, and is projected to surge to USD 75.32 billion by 2034, growing at a remarkable CAGR of 27.94% through the forecast horizon.

The Europe pharmaceutical CDMO market size was USD 35.48 billion in 2024, increased to USD 37.98 billion in 2025, and is projected to reach USD 70.05 billion by 2034, registering a CAGR of 7.04%.

The U.S. pharmaceutical CDMO market was valued at USD 36.77 billion in 2024, rose to USD 39.14 billion in 2025, and is estimated to grow to USD 68.57 billion by 2034, advancing at a CAGR of 6.43%.

On a global scale, the pharmaceutical CDMO market was valued at USD 146.05 billion in 2023 and is set to grow steadily, reaching USD 315.08 billion by 2034, with a CAGR of 7.24% from 2024 to 2034.

The pharmaceutical logistics market was valued at USD 105.6 million in 2023 and is anticipated to grow to USD 191.1 million by 2034, reflecting a CAGR of 5.54% over the forecast period.

The global pharmaceutical packaging market stood at USD 139.40 billion in 2023 and is expected to expand robustly to USD 387.50 billion by 2034, growing at a CAGR of 9.74% between 2024 and 2034.

Meanwhile, the generic pharmaceuticals market was valued at USD 392.23 billion in 2023 and is forecasted to soar to USD 947.67 billion by 2034, advancing at a CAGR of 8.35% over the same timeframe.

Segments Covered in The Report

By Product

- Polymers

- MCC

- HPMC

- Ethyl Cellulose

- Methyl Cellulose

- CMC

- Croscarmellose Sodium

- Povidone

- Pregelatinized starch

- Sodium starch glycolate

- Polyethylene Glycol

- Acrylic Polymers

- Alcohols

- Glycerin

- Propylene Glycol

- Sorbitol

- Mannitol

- Others

- Sugar

- Lactose

- Sucrose

- Others

- Minerals

- Calcium Phosphate

- Calcium Carbonate

- Clay

- Silicon Dioxide

- Titanium Dioxide

- Others

- Gelatin

By Formulation

- Oral

- Topical

- Parenteral

- Others

By Function

- Fillers & Diluents

- Suspending & Viscosity Agents

- Coating Agents

- Binders

- Flavoring Agents & Sweeteners

- Disintegrants

- Colorants

- Lubricants & Glidants

- Preservatives

- Emulsifying Agents

- Others

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5535

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.