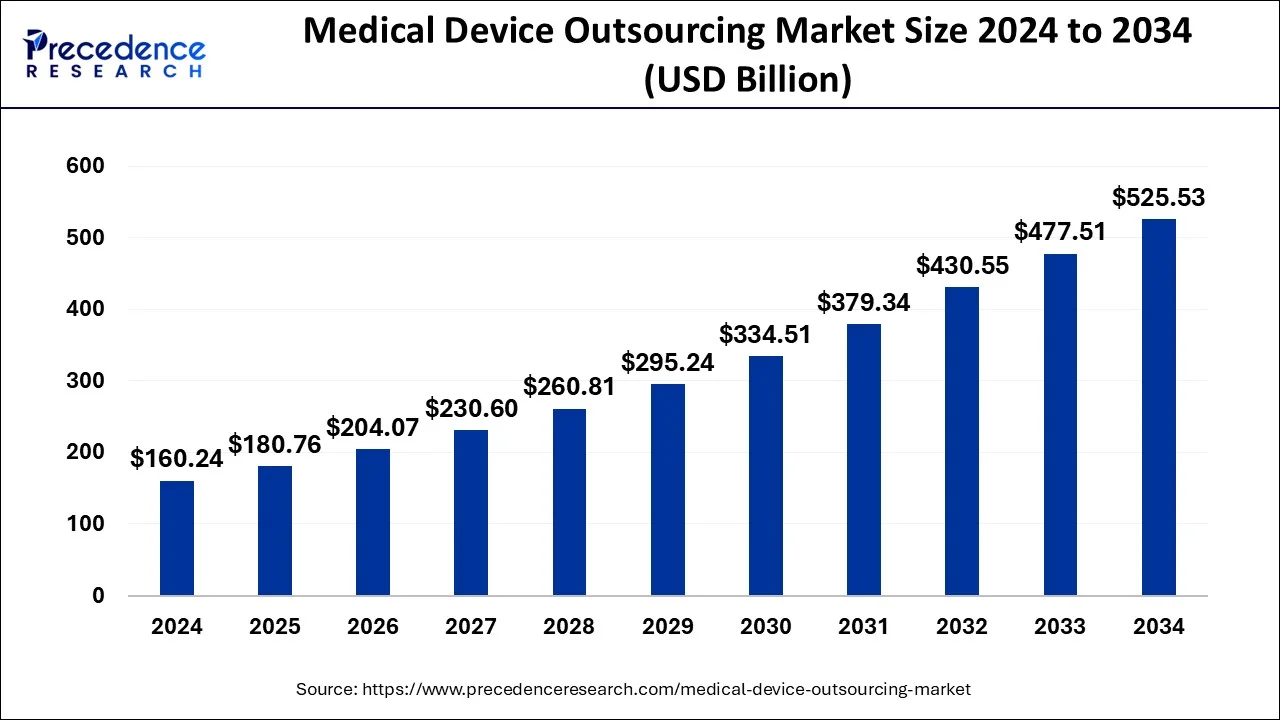

Medical Device Outsourcing Market Size Worth USD 525.53 Billion by 2034 Driven by Rising Regulatory Complexity and Demand for Specialized Expertise

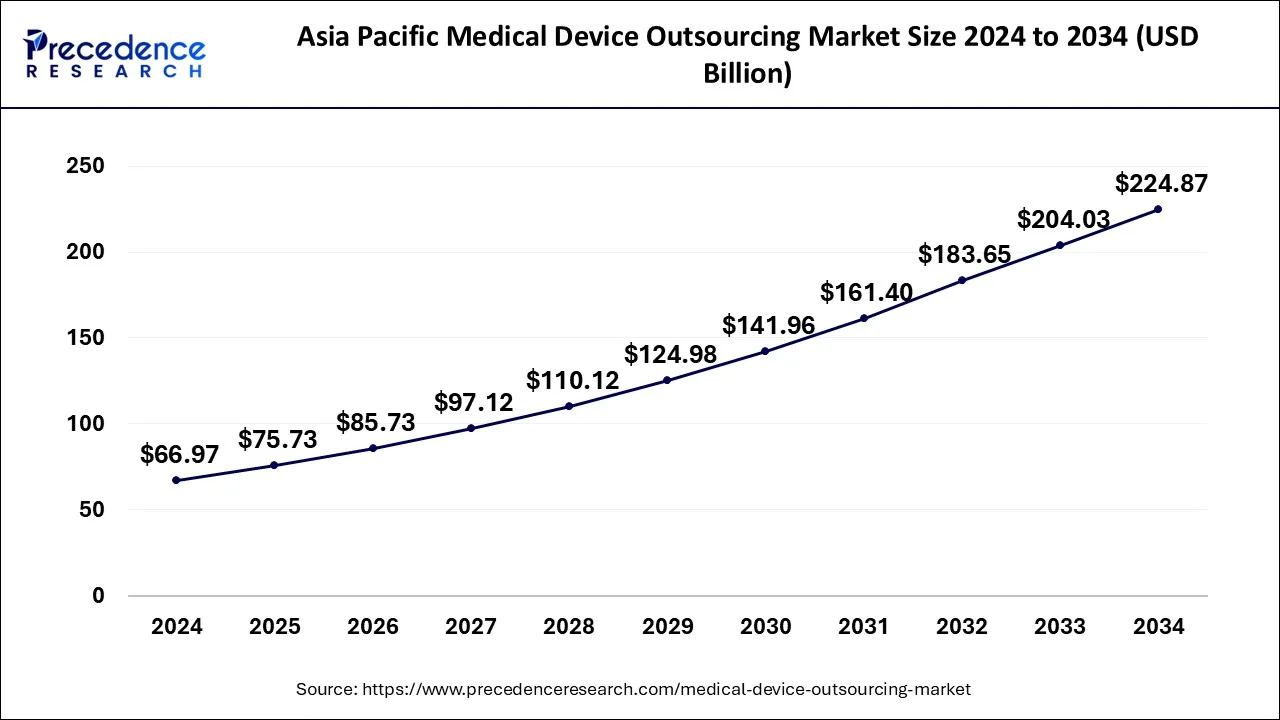

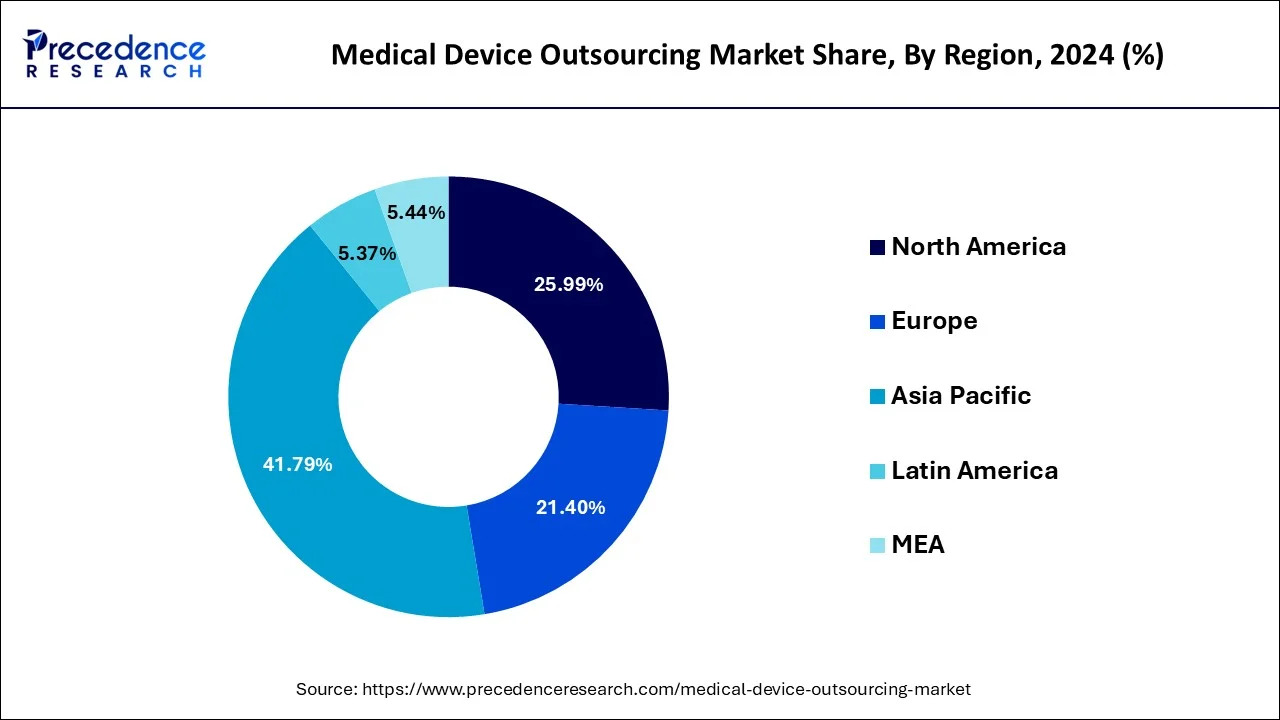

The global medical device outsourcing market size is valued at USD 180.76 billion in 2025 and is expected to be worth over USD 525.53 billion by 2034, growing at a notable CAGR of 12.61% from 2025 to 2034. Asia Pacific accounted for the largest market share of 41.79% in 2024, while North America is projected to grow at the fastest CAGR of 12.5% through 2034.

Ottawa, Oct. 07, 2025 (GLOBE NEWSWIRE) -- According to Precedence Research, the global medical device outsourcing market size will grow from USD 180.76 billion in 2025 to nearly USD 525.53 billion by 2034. In terms of CAGR, the market is expected to grow at a double-digit CAGR of 12.61% from 2025 to 2034.

The rising complexity of regulatory compliance, increasing demand for specialized expertise, and the need for cost reduction and operational flexibility are driving the growth of the market.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1057

Key Takeaways:

- Asia Pacific dominated the global market by holding more than 41.79% of market share in 2024.

- North America is growing at a notable CAGR of 12.5% from 2025 to 2034.

- By application, the cardiology segment contributed the biggest market share in 2024.

- By service, the quality assurance segment held the major market share of 9.56% in 2024.

- By service, the regulatory affairs services segment is projected to grow at a strong CAGR of 13.5% from 2025 to 2034.

Medical Device Outsourcing Market Size, Growth, and Forecast

- Market Size in 2024: USD 160.24 Billion

- Market Size in 2025: USD 180.76 Billion

- Forecasted Market Size by 2034: USD 525.53 Billion

- CAGR (2025–2034): 12.61%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

What is Medical Device Outsourcing?

Medical device outsourcing refers to the production, distribution, and use of medical devices. Medical device outsourcing is a practice in which medical device companies engage with outside parties to perform all or part of the design, development, manufacturing, and sometimes packaging of medical devices. Medical outsourcing is a business process used by organizations like nursing homes, hospitals, and healthcare provider practices to obtain healthcare technicians, nurses, physicians, or other services in a managed service model. A test kit, machine, tool, instrument, or implant that is used to prevent, diagnose, or treat disease or other conditions.

Medical devices range from tongue depressors to heart pacemakers and medical imaging equipment. The medical device outsourcing benefits include improved focus on innovation, access to advanced technology and infrastructure, risk management & continuity, improved customer service, improved flexibility and scalability, and cost efficiency. These devices enhance quality of life, foster independence, and contribute to a healthier community.

Key Sustainability Trends in Medical Device Outsourcing

-

Circular Economy & Device Reprocessing: More outsourcing providers are offering services around reprocessing single-use devices, reuse programs, take-back schemes, and designing devices for disassembly and recyclability. This helps reduce waste, lower lifecycle emissions, and align with both environmental regulations and cost-saving initiatives.

-

Eco-friendly Materials & Biodegradables: There’s a growing shift toward using biodegradable polymers and renewable, bio-based materials instead of traditional plastics. Outsourcers are helping manufacturers integrate these materials into device components to reduce environmental impact and dependency on fossil-based inputs.

-

Energy Efficiency & Emissions Reduction: Contract manufacturers and service providers are investing in energy-efficient equipment, renewable energy sources, and emissions tracking tools. They are also adopting digital technologies like simulation and digital twins to optimize production and reduce carbon footprints.

-

Sustainable Packaging & Supply Chain Transparency: Outsourcing firms are increasingly developing recyclable, lightweight, and bio-based packaging options. Simultaneously, supply chains are under scrutiny for sustainability credentials, prompting greater transparency in material sourcing, waste handling, and environmental compliance.

-

Life Cycle Assessment (LCA) & Regulatory Pressure: Life Cycle Assessment is being integrated into product design and outsourcing decisions to better understand and minimize environmental impacts. At the same time, stricter regulations are pushing companies to disclose environmental data and adopt more sustainable practices across the device lifecycle.

✚ Access Detailed Market Insights@ https://www.precedenceresearch.com/medical-device-outsourcing-market

What are the Key Trends of the Medical Device Outsourcing Market?

- Stricter Global Regulations: Increasingly complex regulatory frameworks like the EU MDR and FDA updates are pushing manufacturers to outsource to experts for compliance support. This helps reduce risk and streamline approval timelines.

- Rising Demand for Specialized Testing: Advanced medical devices require complex testing such as biocompatibility, sterilization, and electrical safety. Outsourcing partners with niche capabilities are becoming essential for meeting these needs.

- Focus on Cost Reduction and Efficiency: Companies are outsourcing manufacturing and non-core functions to lower operational costs and speed up production. This enables them to focus more on R&D and innovation.

- Shift Toward End-to-End Outsourcing Solutions: Manufacturers are favoring partners that offer integrated services from design to post-market support. These full-service models enhance coordination and reduce time to market.

-

Expansion in Emerging Markets: Outsourcing is growing in regions like Asia-Pacific and Latin America due to lower costs and a skilled workforce. These markets also provide access to new patient populations for clinical research.

Medical Device Outsourcing Market Opportunity

Technological Advancements

Technological advancement in medical devices will be an opportunity for the medical device outsourcing market. Advancements in medical devices include wearable health trackers, patient empowerment & education, improved patient education, improving healthcare productivity, electronic health records, easy-to-access medical patient records, data-driven decisions, enhanced care accessibility, decreased costs, and improved patient monitoring.

The application of current technological advancements in the internal processes of companies allows for increased productivity, improving decision-making, and enhancing management, among other possible benefits.

Medical Device Outsourcing Market Challenges

Complexity in Global Supply Chain Management

Complex global supply chain management can limit the growth of the market. Supply chain management disadvantages include information leakages, a lack of visibility, and risks involved with data security, which generally occur when supply chain management is being handled by unreliable third-party service providers. Such disruption can result in hampered productivity, production disruptions, and major negative consequences for business operations. Supply chain disruptions can cause a company to be unable to fulfill customers’ demands.

Case Study: Scaling a Class II Cardiology Device via End-to-End Outsourcing

Context

A mid-size U.S. OEM (“CardioTech”) planned a next-gen ambulatory cardiac monitor but faced:

- EU MDR/US FDA regulatory complexity.

- Cleanroom capacity constraints and long tooling lead times.

- Fragmented supplier base for electronics, molding, and sterilization.

Objectives

- Cut time-to-market by ≥30%.

- Lower unit cost by ≥10% without sacrificing quality.

- Achieve simultaneous FDA 510(k) clearance and EU MDR CE Mark.

- Build a resilient, auditable supply chain with sustainability gains.

Outsourcing Model

- Design & DFM: Partner A (EU) for human-factors, biocompatibility strategy, risk management (ISO 14971), and DHF remediation.

- Electronics/Mechatronics: Partner B (APAC) for PCBAs, flex circuits, micro-motors; IPC-A-610 Class 3.

- Injection Molding & Assembly: Partner C (Mexico) for high-cavitation tooling, over-molding, ultrasonic welding; ISO 13485/21 CFR 820.

- Sterilization & QA: EO sterilization with validated cycles; independent Partner D for lot release testing, accelerated aging, and packaging validation (ASTM D4169/ISO 11607).

- Regulatory Affairs: Central RA PMO coordinating NB queries, FDA RTA checks, UDI/GUDID, and PMS/PMPF plans.

- Digital Thread: PLM + eQMS integration (DHF/DMR, eDHR, CoA ingestion), SPC dashboards, and supplier scorecards.

Execution Highlights

- DFM/DFX sprints: 3× two-week iterations eliminated two secondary ops; BOM consolidated from 128 to 103 line items.

- Tooling strategy: Bridge tools in 6 weeks; progressive move to production tools in 14 weeks with identical resin specs.

- Process validation: IQ/OQ/PQ completed in 9 weeks; Cpk ≥1.67 on critical dimensions; EO sterilization half-cycle + full-cycle completed with SAL 10⁻⁶.

- Regulatory: Biocompatibility per ISO 10993 battery of tests planned once, cross-leveraged in both submissions; combined clinical evaluation + performance bench matrix pre-agreed with NB.

Outcomes (12-Month Program)

- Time-to-Market: Cut from 18.1 to 11.0 months (–39%).

-

Unit Economics:

- COGS –14.3% (materials –8.1%, labor –5.0%, scrap –1.2%).

- CAPEX avoided: $34.7M via contract capacity utilization.

-

Quality:

- Final test yield 98.9% (↑ from 96.2%).

- Field failure rate 0.62% at 12 months (↓ from 1.84% on prior gen).

- Audit performance: major NCs reduced by 60% across supplier base.

-

Regulatory:

- FDA 510(k) clearance at Month 10; EU MDR CE Mark at Month 11.

- 100% on-time responses to NB and FDA info requests.

-

Supply Resilience:

- Dual-sourced ASIC and battery cells; 15-day buffer inventory nearshore; lead-time volatility reduced by 47%.

-

Sustainability:

- 24% reduction in packaging mass; 30% recycled content.

- Scope 2 intensity per unit –22% using renewable PPAs at assembly site.

- Closed-loop regrind on runners; documented LCA boundaries and impacts.

-

Financial Impact:

- 4.5-month revenue pull-forward; $51.3M incremental YoY sales.

- Program NPV +$23.8M at 10% WACC.

What Mattered

- Early RA engagement prevented re-testing loops and shortened CE review.

- Digital SPC at suppliers flagged a drift in over-mold adhesion within 72 hours, avoiding a 12-week recall risk.

- Bridge-to-production tooling kept learning curves on critical dimensions off the customer’s balance sheet.

- Nearshore/Offshore split balanced labor arbitrage with logistics risk, cutting landed cost while improving OTIF.

Transferable Practices

- Lock a single, cross-jurisdictional verification plan to satisfy FDA + MDR concurrently.

- Stand-up a supplier PMO with authority over PPAP/APQP gates and real-time eDHR visibility.

- Treat sterilization and packaging validation as critical path; book EO/E-beam capacity at program kick-off.

- Formalize sustainability KPIs (energy/kWh per unit, packaging grams/unit, scrap %) in MSAs to align incentives.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Medical Device Outsourcing Market Report Coverage

| Report Attributes | Key Statistics |

| Market Size in 2024 | USD 142.19 Billion |

| Market Size in 2025 | USD 180.76 Billion |

| Market Size by 2034 | USD 430.55 Billion |

| CAGR from 2025 to 2034 | CAGR of 13.10% |

| Leading Region in 2024 | Asia Pacific (41.79% share in 2024) |

| Fastest Growing Region | North America (CAGR of 12.5%) |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Application, and Region |

| Leading Segment by Service | Quality Assurance (9.56% share in 2024) |

| Fastest-Growing Segment by Service | Regulatory Affairs Services (CAGR of 13.5%) |

| Leading Segment by Application | Cardiology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Market Drivers | Rising regulatory complexity, growing demand for cost efficiency, and increasing need for specialized expertise |

| Emerging Opportunities | Integration of AI and digital manufacturing technologies in device production |

| Sustainability Trends | Circular economy initiatives, eco-friendly materials, and life cycle assessment (LCA) integration |

| Major Players | Charles River Laboratories, NAMSA, SGS SA, Wuxi AppTec, Eurofins Scientific, Intertek Group |

| Recent Development | In June 2025, Philips Medisize launched TheraVolt medical connectors to enhance device performance and integration. |

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Medical Device Outsourcing Market Regional Insights

What is the Asia Pacific Medical Device Outsourcing Market Size?

The Asia Pacific medical device outsourcing market size surpassed USD 66.97 billion in 2024 and is expected to reach approximately USD 224.87 billion by 2034, growing at a CAGR of 12.87% from 2025 to 2034.

How Asia Pacific Dominated the Medical Device Outsourcing Market?

Asia Pacific dominated the global market with a share of 41.79% in 2024 due to the increasing need for validation and verification of medical devices, rapid & consistent advancement in medical technologies, increasing number of companies, rising demand for innovative medical technologies, strict quality standards, and rising focus on strict approval norms in the region. India is growing fast as a key market for medical device outsourcing.

Original equipment manufacturers (OEMs) of Asian healthcare infrastructure are seeking affordable manufacturing solutions and specialized expertise. The large base of talent advantages and increased demand for complex medical devices in diagnostic imaging treatments are fostering market growth.

- In January 2025, the LMD-32M1MD 32-inch 4K HDR Mini-LED Surgical Monitor, designed to deliver an unparalleled viewing experience in medical environments, was launched by Sony Electronics, Inc. The LMD-32M1MD features the latest innovative Sony technology, ideal for clinical staff and surgeons. (Source: https://www.mpo-mag.com)

- China is currently dominating the regional market due to its robust manufacturing infrastructure, cost-effective labor, and rapidly advancing capabilities in high-precision engineering and quality control. The country has heavily invested in its medical technology sector, supported by government initiatives like "Made in China 2025," which aim to elevate local innovation and production standards. Additionally, China’s large and growing domestic healthcare market attracts global medical device companies seeking regional partnerships and contract manufacturing.

Why is North America the Fastest Growing in the Medical Device Outsourcing Market?

North America is anticipated to grow at the fastest rate in the market during the forecast period because of the rising senior population, leading to demand for medical devices, increasing prevalence of chronic diseases, increasing demand for advanced medical devices, and demand for high-quality products.

Outsourcing is a practice where a company hires an external party to perform services or produce goods to reduce costs and improve efficiency. The existence of key market players is their strategic collaboration with integrated design and manufacturing services are driving the outsourcing of specialized process in the region’s healthcare infrastructure. The strong focus on the adoption of cutting-edge technologies like AI and IoT devices is further contributing to the market expansion.

- In March 2025, a US-based accelerator for European and Israeli device startups to scale into the American Healthcare Market was marked by MarketWinch. The new service package significantly accelerates market entry, reduces costs, and helps startups navigate the complexities of the US healthcare system. (Source: https://www.medicaldesignandoutsourcing.com)

Major Countries and Their Sustainable Investments & Funding for Medical Device Sourcing:

-

India: In March 2024, Wipro GE Healthcare announced plans to invest over ₹8,000 crore (approximately $960 million) in India over the next five years, focusing on enhancing local manufacturing and R&D capabilities for advanced medical devices like PET CT scanners and MR coils.

-

China: Mindray acquired Germany-based DiaSys Diagnostic Systems for over $660 million in 2021, expanding its global footprint in the medical device sector

-

United States: Medtronic invested approximately $1.2 billion in expanding its manufacturing facilities in the U.S., focusing on the production of advanced medical devices and technologies.

-

Germany: Siemens Healthineers invested over €2 billion in expanding its global manufacturing and R&D facilities, focusing on medical imaging and laboratory diagnostics.

-

Mexico: Flex Ltd. established a state-of-the-art medical device manufacturing facility in Tijuana, Mexico, to cater to the growing demand in North America.

Medical Device Outsourcing Market Segmentation Insights

Service Insights

Which Service Dominated the Medical Device Outsourcing Market in 2024?

The quality assurance segment dominated the market with a share of 9.56% in 2024 and will gain a significant share of the market over the studied period of 2025 to 2034. Medical device quality assurance is the systematic approach implemented to ensure that medical devices are of uniform and high quality throughout their lifecycle. The main goal of medical device quality assurance is to guarantee the reliability, safety, and efficacy of medical devices throughout their lifecycles, from conception and development to manufacturing, distribution, and post-market surveillance.

- In August 2025, Boulder BioLabs for device packaging and distribution testing service was launched by Boulder BioMed. Services include real-time aging testing, accelerated aging testing, impact testing, vibration testing, compression testing, drop testing, and environmental testing. (Source: https://www.medicaldesignandoutsourcing.com)

The regulatory affairs services segment is the fastest-growing in the market due to several key factors. The increasing complexity of global regulatory requirements, such as the European Union Medical Device Regulation (EU MDR) and the U.S. FDA's stringent approval processes, has compelled medical device companies to seek specialized expertise to navigate these challenges efficiently. The rapid pace of technological advancements in medical devices necessitates timely regulatory submissions and approvals to ensure market access.

Application Insights

What Made the Cardiology Segment Lead the Medical Device Outsourcing Market?

The cardiology segment led the market in 2024. Cardiac implantable electronic devices, including cardiac loop recorders, biventricular pacemakers, implantable cardioverter defibrillator (ICD), and pacemakers, are designed to help control or monitor irregular heartbeats in people with specific heart rhythm diseases and heart failure. Implantable devices can be used to help control irregular heartbeats and support the heart’s pumping function.

The general and plastic surgery segment is set to experience the fastest rate of market growth from 2025 to 2034. Plastic surgeons use many varieties of tools, depending on the procedure they are performing. As a plastic surgeon, we use many general surgery tools like drapes, scalpels, sutures, retractors, scissors, forceps, and suction devices. The need for plastics used in medical devices includes shelf life & aging, chemical resistance, biocompatibility, sterilization, and joining & welding.

- In October 2024, two cutting-edge products for wound care, the Peak Powder Collagen Matrix and the ElectroFiber 3D, were launched by Royal Wound-X, a division of Royal Biologics. Peak Powder Collagen Matrix is a next-generation collagen-based wound care solution that has features of improving healing in both surgical and non-surgical wounds. (Source: https://www.mpo-mag.com)

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Medical Device Outsourcing Market Key Players

-

Charles River Laboratories International, Inc. - Charles River offers comprehensive preclinical and clinical laboratory services to support the development, safety, and efficacy of medical devices through every stage of the product lifecycle.

-

North American Science Associates, Inc. (NAMSA)- NAMSA provides end-to-end medical device testing and regulatory consulting services, helping manufacturers bring products to market efficiently and in compliance with global standards.

-

Pace Analytical Services LLC - Pace Analytical supports medical device companies with analytical testing, environmental monitoring, and cleanroom validation to ensure product safety and regulatory compliance.

-

Sterigenics International LLC - Sterigenics specializes in contract sterilization and microbial reduction services using technologies like gamma, ethylene oxide (EO), and electron beam for medical device manufacturers.

-

American Preclinical Services - American Preclinical Services offers GLP-compliant preclinical testing, surgical research, and bioskills training services tailored to the development and validation of medical devices.

-

Eurofins Scientific - Eurofins provides a wide range of laboratory services, including biocompatibility, chemical characterization, and microbiological testing, supporting global medical device regulatory submissions.

-

Toxicon, INC. - Toxicon delivers specialized toxicology, microbiology, and analytical chemistry testing services to meet the safety and performance requirements of medical devices.

-

SGS SA - SGS offers a full suite of medical device testing, inspection, certification, and auditing services to help manufacturers navigate regulatory pathways worldwide.

-

Wuxi AppTec - Wuxi AppTec supports the medical device industry with integrated services ranging from material characterization and biocompatibility testing to regulatory and consulting support.

-

TÜV SÜD AG - TÜV SÜD provides certification and conformity assessment services for medical devices, including CE marking and ISO 13485 certification, ensuring compliance with international regulations.

-

Intertek Group PLC - Intertek offers comprehensive medical device testing and certification solutions, including electrical safety, EMC testing, and biocompatibility evaluations to facilitate market access.

Recent Developments:

- In June 2025, the launch of TheraVolt medical connectors was announced by Philips Medisize, a Molex company and a leader in the design, engineering, and manufacturing of medtech, pharmaceutical drug delivery, and in vitro diagnostic devices. As the first medical connectors launched under the Philips Medisize brand, TheraVolt is engineered to improve device functionality, integration, performance, and reliability. (Source: https://www.medicaldesignandoutsourcing.com)

- In March 2025, a new product introduction (NPI) center near Boston, Mass., was opened by Flex, a global manufacturing partner. The center supports end-to-end product development from prototype to production transfer, preclinical build, and design verification. It supports customers in lab diagnostic equipment, imaging equipment, medical technology systems, medical devices, and surgical robotics, among a variety of other healthcare products. (Source: https://www.mpo-mag.com)

Segments Covered in the Report

By Service

- Product Upgrade Services

- Regulatory Affairs Services

- Legal representation

- Clinical trials applications

- Regulatory writing and publishing

- Quality Assurance

- Product Maintenance Services

- Product Testing & Sterilization Services

- Product Design and Development Services

- Molding

- Designing & engineering

- Machining

- Packaging

- Product Implementation Services

- Contract Manufacturing

- Accessories manufacturing

- Component manufacturing

- Device manufacturing

- Assembly manufacturing

By Application

- Drug delivery

- Dental

- Diabetes care

- Cardiology

- Endoscopy

- IVD

- Ophthalmic

- Diagnostic imaging

- Orthopedic

- General and plastic surgery

- Others By Regional

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1057

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Related Topics You May Find Useful:

➡️ Medical Device Services Market: Explore how end-to-end service models are reshaping innovation and compliance in medtech

➡️ Medical Device Contract Manufacturing Market: See how OEM partnerships and precision manufacturing drive global device production

➡️ Medical Billing Outsourcing Market: Understand how automation and AI are transforming revenue cycle efficiency in healthcare

➡️ Medical Device Contract Manufacturing Market Press Release: Analyze recent growth momentum and investment opportunities in outsourced medical device production

➡️ Healthcare IT Outsourcing Market: Track how digital transformation and data security are driving outsourcing trends in health IT

➡️ Medical Devices Vigilance Market: Discover how post-market surveillance and AI analytics enhance patient safety

➡️ Healthcare Contract Research Outsourcing Market: Examine how CRO partnerships accelerate clinical trials and regulatory approvals

➡️ Medical Information Market: See how real-time data sharing and digital channels are redefining medical communication

➡️ Laboratory Products and Outsourcing Services Market: Learn how lab automation and outsourcing models are optimizing R&D efficiency

➡️ Medical Device Cleaning Market: Gain insights into how hygiene protocols and eco-friendly solutions ensure device safety

➡️ Regulatory Affairs Outsourcing Market: Understand how global compliance complexities are fueling demand for regulatory expertise

➡️ Life Sciences BPO Market: Discover how specialized outsourcing in life sciences enhances efficiency, scalability, and innovation

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.